As a Financial Coach I know Holidays can be FUN and DAUNTING for my clients.

One of their most common causes of stress – is the toll all this celebrating takes on their finances. My best advice is to plan now for the things that you value and what you can AFFORD with a Holiday Budget.

I suggest you limit how much you spend, or you may find yourself regretting your choices come January and well into the New Year. Let’s put the HAPPY back in the Holidays by becoming intentional with your money and creating a holiday budget.

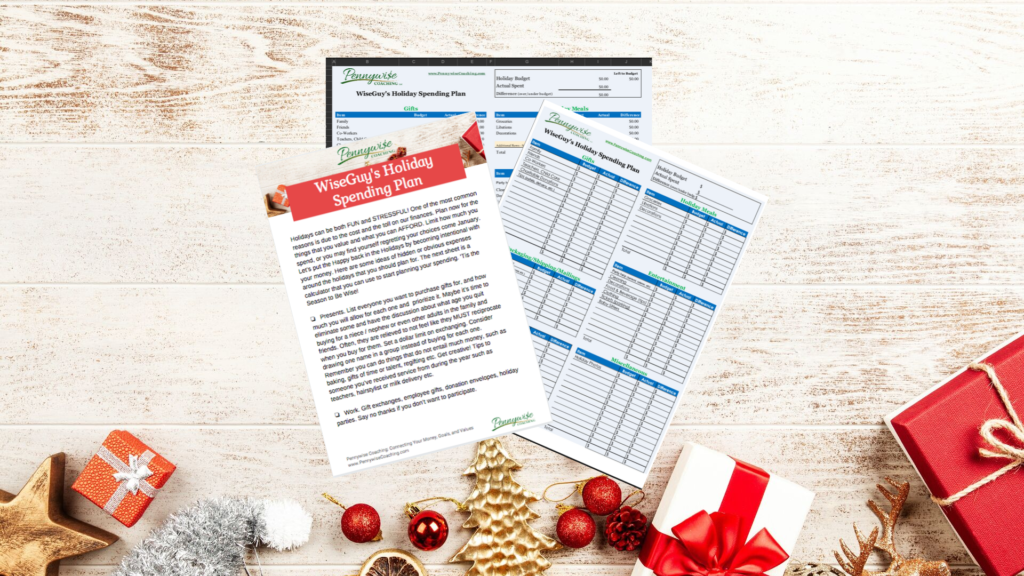

To help you be more intentional with your money this Holiday Season – I have created the WiseGuy Holiday Spending Plan Google Drive Folder – Just sign up for my mailing list and you will receive instant access! This folder and plan include all the tips and tools you will need to plan out a holiday budget you can actually afford – saving you so much financial stress this Holiday season!

These tips and tools can help you plan for all the expenses this holiday season with a holiday budget and plan. The awesome spending plan tool with an automatic calculator is a tool that you can use right now to start planning before you spend too much this season.

So watch my above video then download all these amazing tools for free today. I really hope you use these tools to help you better plan your holiday spending. Save yourself all the stress and regret you normally feel in January!

Your Holiday Hero,

Penny

Want to connect more with me?

Sign up for my mailing list

Connect with me on Facebook

Subscribe to my YouTube channel for all my financial coaching advice!