by Penny Kidd | Mar 19, 2020 | Blog, Finance

“Vacation, all I ever wanted.” The Go-Go’s knew it then, and not much has changed. Vacation is a state of mind, and for many of us, it can help us get through the workweek to have something to look forward to. Many of us stress the financial...

by Penny Kidd | Feb 12, 2020 | Blog

How a better relationship with money can make for a better relationship with your spouse We all know that fighting about money is an issue most couples face. According to the Institute for Divorce Financial Analysis, money matters are the third leading cause of...

by Penny Kidd | Jan 27, 2020 | Blog, Finance

You are not alone in your struggle. “Money problems” feel like such an isolated thing – that you did something wrong, or you somehow got yourself into this. These are the awful things that our minds love to tell us, but this is so untrue. Current...

by Penny Kidd | Nov 13, 2019 | Blog, Finance

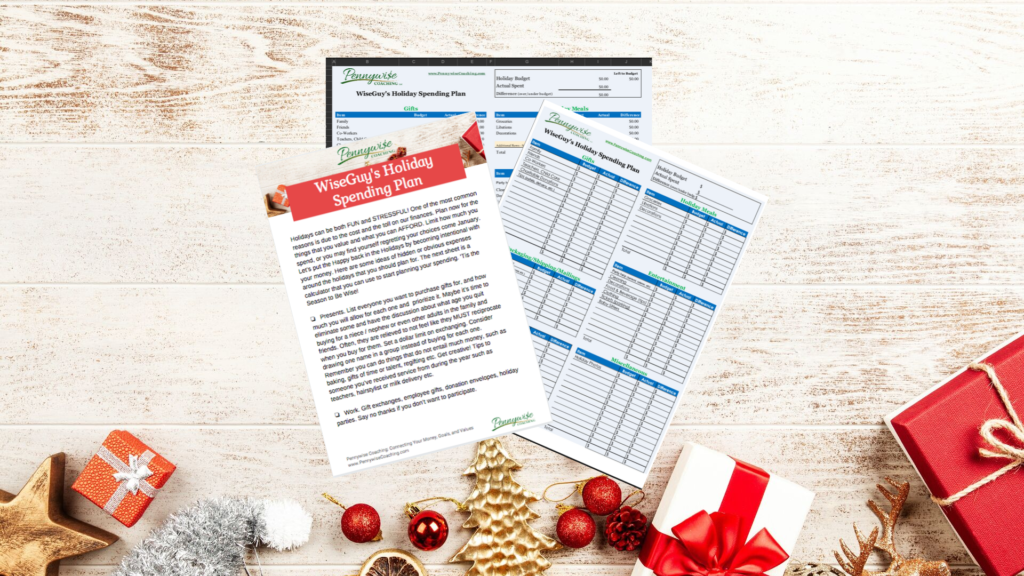

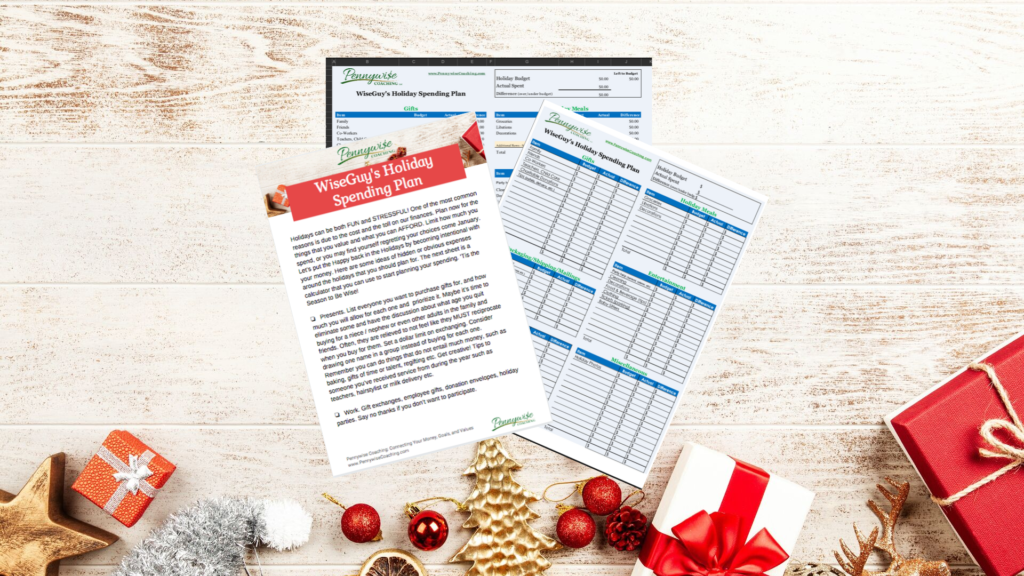

The Winter holidays are costly in both time and money. Most people are not really aware of where they are spending and truly how much. Many people are spending beyond their budget. Most are still paying for unplanned holiday expenses well into the next year! As a...

by Penny Kidd | Nov 4, 2019 | Blog, Finance

“What do you really know about your money? Where do you go to find out about your financial health? Will you outlive your money? Penny Kidd of PennyWise Coaching is here to help. ” Guest appearance on my Friend Rikki Smith’s Youtube show Faith on...

by Penny Kidd | Oct 16, 2019 | Blog, Finance

As a Financial Coach I know Holidays can be FUN and DAUNTING for my clients. One of their most common causes of stress – is the toll all this celebrating takes on their finances. My best advice is to plan now for the things that you value and what...